News

Acticor Biotech completes a capital increase for a total gross amount of 8 million euros

Acticor Biotech completes a capital increase

for a total gross amount of 8 million euros

Paris, France, March 15, 2024 – 8:00 am CET - ACTICOR BIOTECH (ISIN: FR0014005OJ5 - ALACT - the "Company"), a clinical-stage biotechnology company developing glenzocimab, a novel drug for the treatment of cardiovascular emergencies, in particular stroke, today announces the successful completion of its capital increase for a total gross amount of 8 million euros, through the issue of 2,566,086 new shares at a price of € 3.13 per share.

Following the success of the transaction, ACTICOR BIOTECH will use the proceeds of the capital increase to pursue its development plan in the emergency treatment of stroke. The Company mainly plans to use the funds raised to:

-

Finalization of phase 2/3 of the ACTISAVE study, with results expected in Q2 2024;

-

Validation of the global registration plan with the regulatory authorities (FDA and EMA); and

-

Preparation of the additional studies required to register glenzocimab in Europe and the United

States.

On the basis of planned expenditure, the net cash balance and net financial debt at December 31, 2023, which amount respectively to €3.9 million and €3.3 million (unaudited), and the funds raised, the Company estimates that it will be able to finance its operations until october 2024. Beyond that, the Company's financing needs to meet its obligations over the next 12 months are estimated by the Company at around €5 additional million.

Main characteristics of the Offer

The Offer, for a total amount, including issue premium, of 8 million euros, was carried out by the issue, without preferential subscription rights and without a priority subscription period, of 2,566,086 new ordinary shares, in the context of (i) a reserved offer for the benefit of specific categories of investors (the "Reserved Offer"), (ii) a private placement with institutional investors for the benefit of qualified investors or a limited circle of investors (the "Private Placement"), and (iii) a public offering without a designated beneficiary intended for individuals of French nationality or nationals of member states of the European Economic Area, via the PrimaryBid platform (the "PrimaryBid Offering").

As part of the Offer:

-

- 2,261,260 new ordinary shares were subscribed for by investors in the Reserved Offering for a

total amount of approximately 7.1 million euros;

-

- 304,826 new ordinary shares were subscribed for by investors in the PrimaryBid Offer for retail

investors via the PrimaryBid platform, for a total amount of approximately 1 million euros.

It should be noted that no new ordinary shares were subscribed for under the Private Placement.

The new ordinary shares, representing approximately 19.46% of the Company's share capital, on a non-diluted basis, before completion of the Offer and 16.29% of the Company's share capital, on a non-diluted basis, after completion of the Offer, were issued yesterday evening by decisions of the Company's Chief Executive Officer pursuant to the sub-delegations of authority granted by the Company's Board of Directors on March 8, 2024, in accordance with the 12th and 13th resolutions of the Company's Annual General Meeting of May 12, 2023 (the "AGM").

-

The issue price of the new ordinary shares has been set at €3.13 per share, representing a discount of

25.65% to the closing price of the ACTICOR BIOTECH share March 14, 2024, i.e. €4.21, and of 29.67%

to the volume-weighted average price of the ACTICOR BIOTECH share on the Euronext Growth

multilateral trading facility over the last 3 trading sessions prior to its setting (i.e. from 12 to 14 March

2024 inclusive), i.e. €4.4506, in accordance with the decision of the Chief Executive Officer of 14 March

2024 acting by sub-delegation and the resolutions of the Annual General Meeting.

It is specified that all the directors of the Company (or the permanent representatives of the legal entities that are directors of the Company), who have themselves undertaken to subscribe to the Offer, did not take part in the vote on the decision of the Board of Directors delegating to the Chief Executive Officer the authority to launch the Offer and set its final terms.

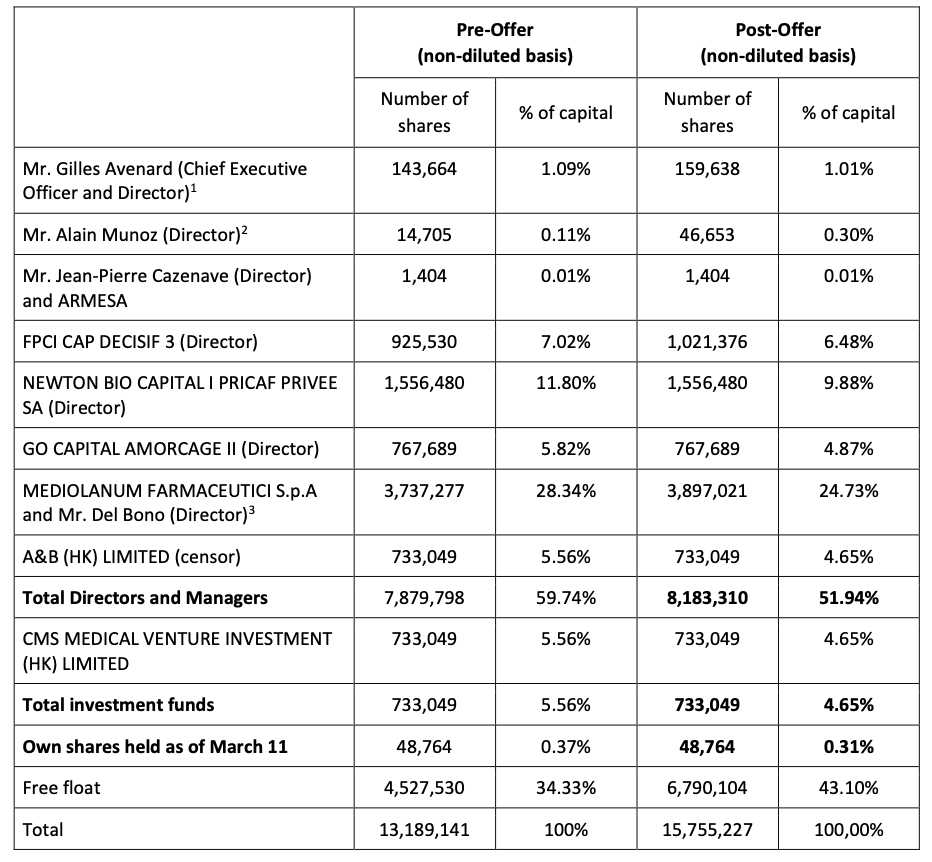

To the best of the Company's knowledge, the breakdown of shareholders before and after completion of the Offer is as follows: